TrendForce's latest report highlights that memory suppliers are increasing their production capacity in response to growing orders from NVIDIA and CSPs for their own-designed chips. These efforts include expanding TSV production lines to boost HBM output. Forecasts based on suppliers' current production plans indicate a significant 105% annual increase in HBM bit supply by 2024. However, due to the time required for TSV expansion, including equipment delivery and testing (9 to 12 months), the majority of HBM capacity is expected to be available by 2Q24.

TrendForce analysis suggests that 2023 to 2024 will be crucial years for AI development, leading to a substantial demand for AI Training chips and increased utilization of HBM. However, as the focus shifts to Inference, the annual growth rate for AI Training chips and HBM is expected to slightly decrease. The upcoming surge in HBM production presents suppliers with a challenging situation: they must balance meeting customer demand to expand market share while avoiding overproduction and potential risks of overbooking. HBM3 is expected to significantly boost HBM revenue in 2024 with its higher ASP.

In 2022, the HBM market had sufficient supply. However, the explosive surge in AI demand in 2023 has prompted clients to place advance orders, pushing suppliers to their capacity limits. Looking ahead to 2024, TrendForce predicts that aggressive expansion by suppliers will increase the HBM sufficiency ratio from -2.4% to 0.6%.

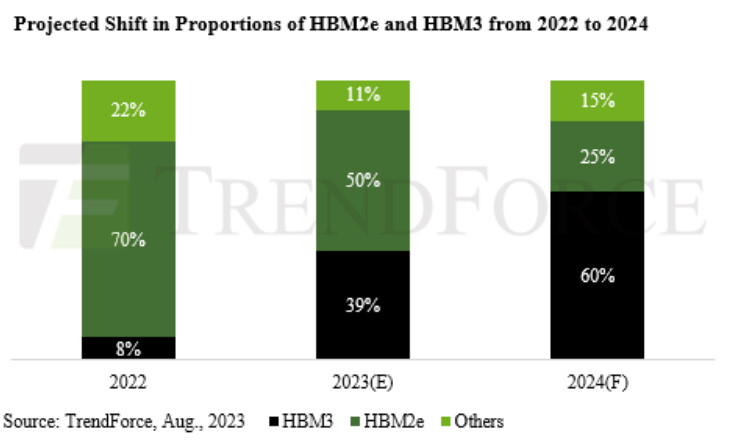

TrendForce believes that the primary demand is shifting from HBM2e to HBM3 in 2023, with an anticipated demand ratio of approximately 50% and 39%, respectively. As more chips adopting HBM3 enter the market, demand in 2024 will heavily favor HBM3 and surpass HBM2e with a projected share of 60%. This expected surge, along with a higher ASP, is likely to lead to a significant increase in HBM revenue next year.

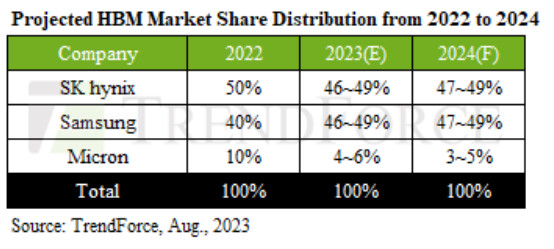

SK hynix currently leads in HBM3 production, serving as the main supplier for NVIDIA's server GPUs. On the other hand, Samsung is focused on fulfilling orders from other CSPs. The market share gap between Samsung and SK hynix is expected to narrow significantly this year due to an increasing number of orders for Samsung from CSPs. Both companies are predicted to have similar shares in the HBM market between 2023 and 2024, collectively occupying around 95%. However, variations in shipment performance may occur across different quarters due to their different customer bases. Micron, which has mainly focused on HBM3e development, may experience a slight decrease in market share in the next two years due to the aggressive expansion plans of these two South Korean manufacturers.

Prices for older HBM generations are expected to decrease in 2024, while HBM3 prices are projected to remain steady. From a long-term perspective, TrendForce notes that the ASP of HBM products gradually decreases year on year. Given the high-profit nature of HBM and its unit price exceeding other types of DRAM products, suppliers aim to gradually reduce prices to stimulate customer demand, resulting in a price decline for HBM2e and HBM2 in 2023.

Although suppliers have not finalized their pricing strategies for 2024, TrendForce does not rule out the possibility of further price reductions for HBM2 and HBM2e products, considering the significant improvement in overall HBM supply and suppliers' efforts to expand their market shares. Meanwhile, HBM3 prices are expected to remain consistent with 2023. With its significantly higher ASP compared to HBM2e and HBM2, HBM3 is poised to boost suppliers' HBM revenue, potentially driving total HBM revenue to reach US$8.9 billion in 2024, a 127% year-on-year increase.